Transmedia Capital

An Early-Stage Venture Fund

Transmedia Capital is a top performing technology venture fund providing

deep domain expertise, operating experience, and advisory relationships.

Market Strategy

Mobile technologies and business cloud applications taking both horizontal or vertical approaches.

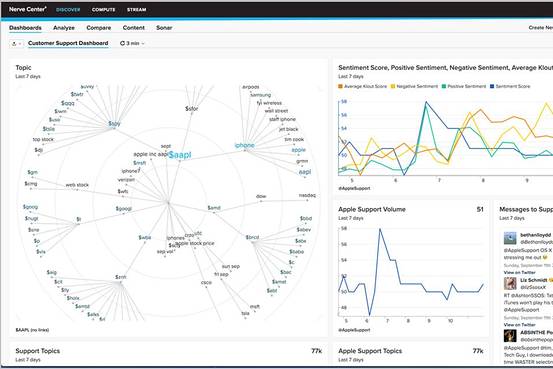

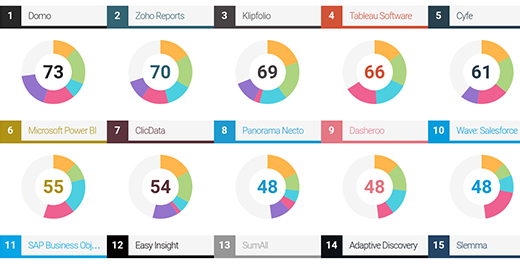

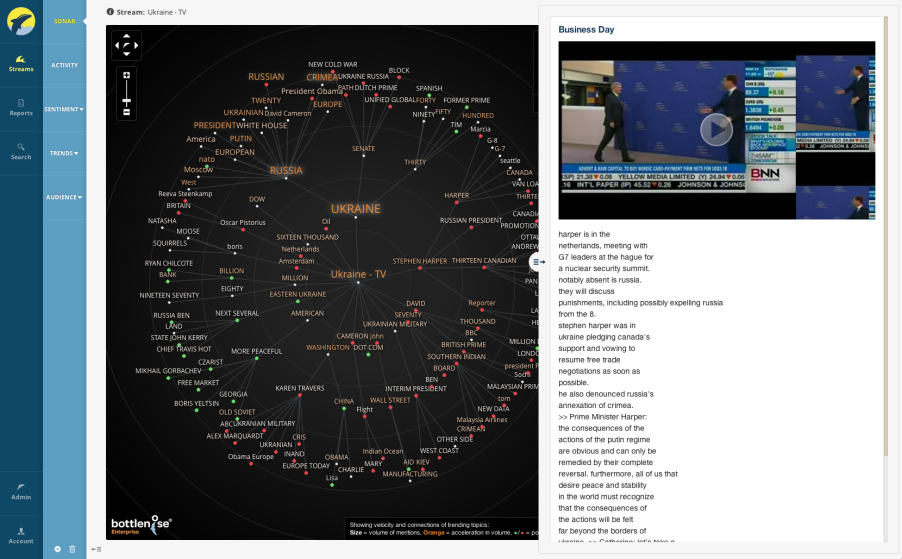

Business Intelligence and SaaS / Enterprise

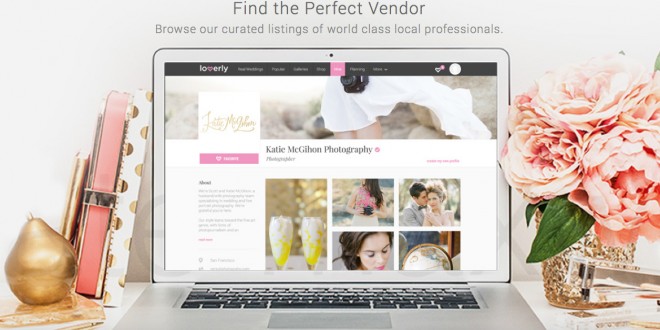

Commerce / Marketplaces

FinTech / Blockchain / NFT

Robotics / AI

Social / Messaging

Technical founders with genuine inspiration

US-headquartered companies post beta / market launch

Defensible approaches utilizing data, economies of scale and network effects

Leaders with strong communication skills who can recruit and build strong teams

Raising less than $5 million in current financing

The TMC partners are actively involved in socially responsible programs, promoting entrepreneurship and diversity within the technology business sector. Chris Redlitz is the co founder of The Last Mile, an entrepreneurship and technology training program that provides opportunities for incarcerated populations in the United States. The Last Mile is the most innovative and successful prison education program in the country. Many TMC portfolio companies have donated their time and effort to help make The Last Mile an effective answer to the high recidivism rates in the United States. In addition to The Last Mile, Chris and his wife Beverly established a scholarship fund for children of The Last Mile participants. This is another step in helping resolve the issues of generational incarceration.

Team

As long-time serial entrepreneurs, Chris and Peter understand the many challenges and obstacles founders must face and overcome in order to be successful.

Chris has been on the forefront of emerging technologies since the commercialization of the web and was the founder Kicklabs, the first technology accelerator based in San Francisco. Chris co founded AdAuction, the first online media exchange in 1997 which was the precursor to the current auction based and dynamic pricing platforms in online media. Chris was instrumental in restructuring the businesses for Get Relevant (acquired by Lycos) and Aptimus (acquired by Apollo LLC).

Chris developed the first online automated coupon platform, launched the first RSS ad campaigns, and helped develop the first peer to peer ad delivery system. As a result, he received Ad Age’s prestigious i20 award for his accomplishments in the development of interactive media and advertising. Chris has been a successful adviser and investor for the last two decades in Silicon Valley with investments in Snap, LinkedIn, Twitter, Facebook, Domo, Compound, Wish and more. Early in his career, Chris worked for Reebok Int’l and continues to pursue his passion for health as an avid fitness enthusiast. In 2010, Chris co founded The Last Mile (TLM), the first technology entrepreneurship and coding program taught in a US prison. TLM has become the most successful prison education program in the country.

Peter has been an early-stage tech investor for over 20+ years and has completed more than 125 startup investments including top search engines Baidu (China) and Yandex (Russia), and more recently: Snap, Wish, AngelList, Armory, Compound Finance, SFOX and Levelup. Today, Peter is focused on fintech/blockchain, enterprise SaaS, marketplaces and e-commerce.

Previously, he was the founder and CEO of Pakana Corporation, a venture-funded company that developed software solutions for online marketplaces. In 1998, Peter was a Managing Partner at Whittman-Hart (NASDAQ: WHIT), a $1 billion global IT solutions provider. Prior, he was a founder and CEO of Axis Consulting, a leading systems integrator specializing in Internet and ERP solutions, which was a self-funded venture that was acquired by Whittman-Hart in 1997 in a deal valued at $60M. After relocating from Australia in 1991, Peter began his US-based career as a consultant with Charles Schwab & Co. He holds a BS degree in Mathematics from Curtin University (Western Australia). When he is not focused on tech investments, Peter is most passionate about his family, wine, food, skiing, and fly-fishing.

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

Portfolio News

TESTIMONIALS

Amongst Scan's many investors, you are the most influential, best to work with, and most valuable, and you always rank at the top of every list. Thank you for being such a great example.

Amongst Scan's many investors, you are the most influential, best to work with, and most valuable, and you always rank at the top of every list. Thank you for being such a great example.

TESTIMONIALS

We couldn't have asked for a better partner than Transmedia Capital. Chris and Peter were always happy to help, and they provided crucial support on initiatives like building our mobile app and exploring ad opportunities.

We couldn't have asked for a better partner than Transmedia Capital. Chris and Peter were always happy to help, and they provided crucial support on initiatives like building our mobile app and exploring ad opportunities.

TESTIMONIALS

TMC supported me in my first venture backed company, and they are supporting me again. They appreciate my hard work and vision, and I appreciate their unwavering support.

TMC supported me in my first venture backed company, and they are supporting me again. They appreciate my hard work and vision, and I appreciate their unwavering support.

TESTIMONIALS

TMC's domain experience and connections in the digital media sector were very helpful as we grew our enterprise business. They brought a seasoned approach to the board room and helped us think through tough decisions.

TMC's domain experience and connections in the digital media sector were very helpful as we grew our enterprise business. They brought a seasoned approach to the board room and helped us think through tough decisions.

TESTIMONIALS

We have a very strong group of investors, providing strategic advice, introductions, and very honest feedback. TMC is always willing to step up to the plate.

We have a very strong group of investors, providing strategic advice, introductions, and very honest feedback. TMC is always willing to step up to the plate.

TESTIMONIALS

My partners at TMC have been extraordinarily supportive, as we launch into a new market. They give me the unvarnished feedback that entrepreneurs need.

My partners at TMC have been extraordinarily supportive, as we launch into a new market. They give me the unvarnished feedback that entrepreneurs need.

TESTIMONIALS

Chris and Peter were very involved in helping us grow our initial customer base, and getting us to a successful acquisition

Chris and Peter were very involved in helping us grow our initial customer base, and getting us to a successful acquisition

TESTIMONIALS

Transmedia believed in our vision, and helped us through several pivots, and now we are rolling

Transmedia believed in our vision, and helped us through several pivots, and now we are rolling

TESTIMONIALS

Chris was one of the first to support me when I became an entrepreneur. He has always answered the call.

Chris was one of the first to support me when I became an entrepreneur. He has always answered the call.

TESTIMONIALS

TMC helped us navigate the challenges of product development, funding, and our eventual (IPO) exit.

TMC helped us navigate the challenges of product development, funding, and our eventual (IPO) exit.

TESTIMONIALS

You guys have both been incredibly helpful and supportive, and I am more than happy to sing your praises as a solid investor partner for anyone who needs a reference.

You guys have both been incredibly helpful and supportive, and I am more than happy to sing your praises as a solid investor partner for anyone who needs a reference.

TESTIMONIALS

My favorite quote reflects how TMC approaches investing and entrepreneurial support - "...think of wisdom as the ability to get the important things approximately right."

My favorite quote reflects how TMC approaches investing and entrepreneurial support - "...think of wisdom as the ability to get the important things approximately right."

T

717 Market St, Suite 100San Francisco, CA 94103